The Innovation Center offers a wealth of valuable information and assistance to meet all your community’s housing needs. We’re here to simplify the complexities of the housing landscape and provide you with the tools you need to thrive. Explore, learn, and embark on your housing journey with confidence.

Name: Randy Speaker

Position: Regional Housing Specialist

E-Mail: randy@nwkeici.org

Phone: (785) 409-0555

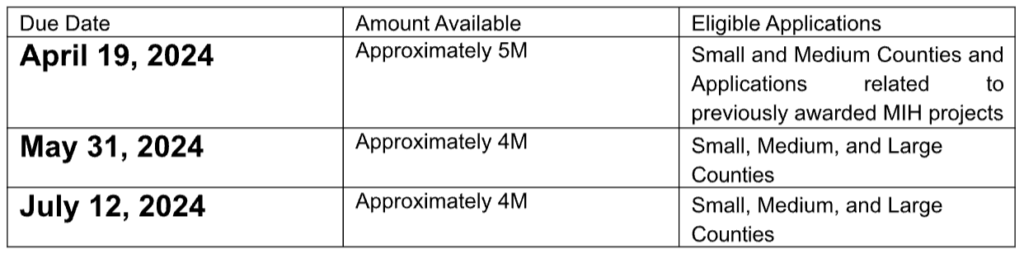

The deadline to submit applications under this RFP is 5:00 PM on the days listed below. These deadlines

may be extended at the sole discretion of KHRC based upon the availability of credits.

Due Date | Amount Available | Eligible Applications |

April 19, 2024 | Approximately 5M | Small and Medium Counties and Applications related to previously awarded MIH projects |

May 31, 2024 | Approximately 4M | Small, Medium, and Large Counties |

July 12, 2024 | Approximately 4M | Small, Medium, and Large Counties |

Submit applications through the online platform Procorem. Information regarding applying through Procorem is located on KHRC’s MIH webpage in the KHITC FAQs as well as the “How to Apply” video. Any applicant intending to apply for KHITC must submit a Notice of Application prior to an application submission. Notices of Application can be found on the KHRC website and should be emailed to MIH@kshousingcorp.org.

Applicants may submit multiple applications. Developer capacity may be considered in the evaluation process.

Draft 2024 KHITC Notice of Application Availability Public Hearing

On Thursday, Feb. 29 at 2:00 p.m., KHRC will host a public meeting to discuss the Draft 2024 Kansas Housing

Investor Tax Credit (KHITC) Notice of Application Availability.

Virtual Public Hearing

Draft KHITC Notice of Availability

Feb. 29 at 2:00 p.m.

The following resources are available on KHRC’s Moderate Income Housing page under Documents | Forms | Resources:

Written comments regarding the draft 2024 KHITC Notice of Application Availability can be submitted by email to MIH@kshousingcorp.org until March 6, 2024.

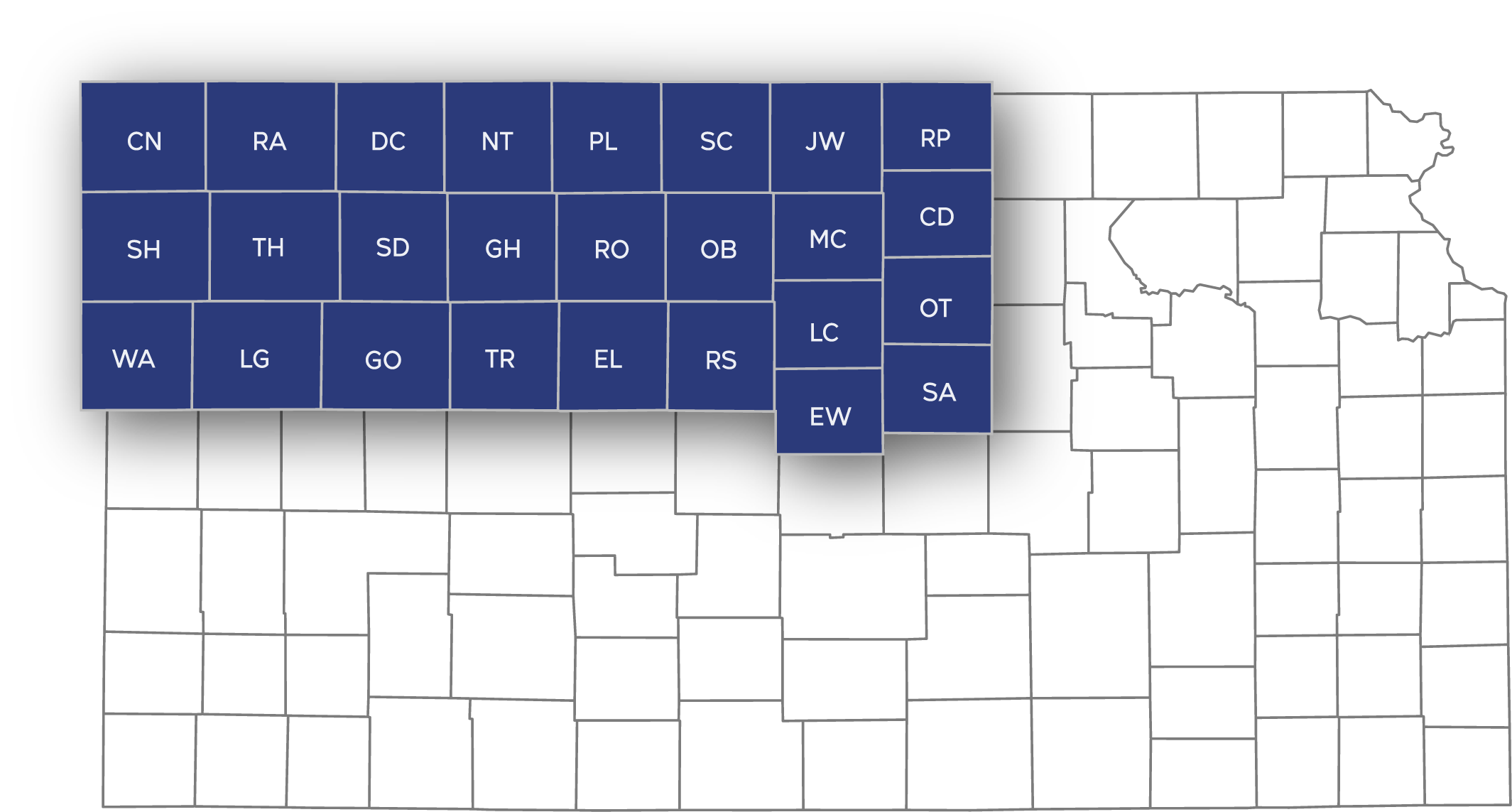

Click on a county to view it’s individual Wage-Analysis document.

Housing Calculator Instructions

Click on a county to view it’s individual Wage-Analysis document.

To unlock the developer visit building files, click the link below.

The Housing Assessment Tool (HAT) is a self-assessment guide for communities to gather and analyze data on their housing inventory, partner with relevant stakeholders, and develop priorities for local housing investment. Communities can use this tool to make data-driven decisions in addressing housing investment opportunities.

The recommended timeline for completing the HAT is approximately one to three months but can be dependent on a community’s capacity. Once the HAT is complete, communities have the option to meet with the Housing Interagency Advisory Committee. This is an opportunity for the community to present their housing priorities to discuss state and federal funding opportunities with state representatives.

Step 1: HAT Guide

Download the HAT Guide to review and began recruiting stakeholders to the community’s housing committee to start Part 1. Track answers on a separate document.

Step 2: HAT Form

Download the HAT Guide to review and began recruiting stakeholders to the community’s housing committee to start Part 1. Track answers on a separate document.

The Housing Assessment Tool (HAT) is a self-assessment guide for communities to gather and analyze data on their housing inventory, partner with relevant stakeholders, and develop priorities for local housing investment. Communities can use this tool to make data-driven decisions in addressing housing investment opportunities.

The recommended timeline for completing the HAT is approximately one to three months but can be dependent on a community’s capacity. Once the HAT is complete, communities have the option to meet with the Housing Interagency Advisory Committee. This is an opportunity for the community to present their housing priorities to discuss state and federal funding opportunities with state representatives.

Reinvestment Housing Incentive District (RHID) provide reimbursements to developers in building housing in rural communities by financing housing development infrastructure or renovations of buildings or structures built over 25 years ago for residential use in a central business district. There must be an established RHID defined by an adopted City or County resolution. RHID captures the incremental increase in property taxes created by the development project for up to 25 years. RHID is available for any city with a population under 60,000, counties under 80,000, or the City of Topeka.

RHID captures the incremental increase in real property taxes created by a housing development project for up to 25 years. The incremental increase can be used to pay debt service on bonds issued to fund the project or transferred to the developer as reimbursement for costs incurred.

For a developer to take advantage of the incentive, the property must be within an established RHID. The City or County governing body establishes an RHID and the incentives by:

RHID is authorized for any city in Kansas with a population less than 60,000, counties under 80,000 or the City of Topeka.

The first type of RHID aids cities, counties, and developers in building housing subdivisions within rural communities by assisting in public infrastructure expenses.

The property tax increment can be used to reimburse costs for the following items:

The Moderate Income Housing (MIH) program serves the needs of moderate-income households that typically don’t qualify for federal housing assistance. MIH grants and/or loans are awarded to cities and counties with populations fewer than 60,000 to develop single or multi-family properties for homeownership or rentals. Projects can be for new construction, rehabilitation, or conversion from another use.

The Moderate Income Housing (MIH) program serves the needs of moderate-income households that typically don’t qualify for federal housing assistance. MIH grants and/or loans are awarded to cities and counties with populations fewer than 60,000 to develop single or multifamily properties for homeownership or rentals. Projects can include new construction, rehabilitation, or conversion from another use.

Housing is a statewide silent crisis. But shortages of safe, affordable housing have the greatest impact on our rural communities. In smaller communities across Kansas, a lack of housing creates challenges in attracting and retaining residents. While employment opportunities are plentiful in many communities, housing options are not.

For maximum statewide impact, KHRC limits grants or loans to no more than $650,000 per awardee. Requests for Proposals are released every four months, with applications due three times per year.

Cities and counties with populations fewer than 60,000.

For More Information, Please Email: MIH@kshousingcorp.org

The purpose of the Kansas housing investor tax credit act is to bring housing investment dollars to communities that

lack adequate housing. Development of suitable residential housing will complement economic development of rural

and urban areas that lack adequate housing resources and enable such communities to attract businesses, employees

and new residents.

• $13 million/year in credits

• Set-asides for smaller counties and credit/unit limits

• Counties with a population of 75,000 or less

• Qualified Housing Projects

• Tying this round to Moderate Income Housing (MIH) program

The Low Income Housing Tax Credit encourages investment of private capital in the development of rental housing by providing credits to offset an investor’s federal income tax liability. Financial institutions, such as banks, insurance companies and government-sponsored enterprises, make equity investments in exchange for receiving the tax credits. Equity from the sale of tax credits reduces the amount of debt financing the property owner incurs. This process reduces the property’s monthly debt service, lowers the operating costs, and makes it economically feasible to develop affordable housing.

LIHTC developments provide safe, decent, affordable housing for households at or below 60% of the Area Median Income for at least 30 years.

The 2023 Low Income Housing Tax Credit application process is open.

KHRC evaluates housing tax credit applications based on several characteristics. Priority is given to proposals that:

The Community Development Block Grant (CDBG) program provides funding for projects that help low- to moderate-income neighborhoods thrive. Projects range from sidewalks to community centers, youth job training programs, and much more.

Startup Housing Opportunity Venture Loan – (SHOVL) Pre-Development Loan Program Loan applications open on Thursday April 21, 2022 The goal of SHOVL is to provide funding to developers for expenses incurred prior to the closing of their permanent financing for housing developments in Kansas communities that have experienced housing challenges.

The Innovation Center offers a wealth of valuable information and assistance to meet all your community’s housing needs. We’re here to simplify the complexities of the housing landscape and provide you with the tools you need to thrive. Explore, learn, and embark on your housing journey with confidence.

Name: Randy Speaker

Position: Regional Housing Specialist

E-Mail: randy@nwkeici.org

Phone: (785) 409-0555

The deadline to submit applications under this RFP is 5:00 PM on the days listed below. These deadlines

may be extended at the sole discretion of KHRC based upon the availability of credits.

Submit applications through the online platform Procorem. Information regarding applying through Procorem is located on KHRC’s MIH webpage in the KHITC FAQs as well as the “How to Apply” video. Any applicant intending to apply for KHITC must submit a Notice of Application prior to an application submission. Notices of Application can be found on the KHRC website and should be emailed to MIH@kshousingcorp.org.

Applicants may submit multiple applications. Developer capacity may be considered in the evaluation process.

Draft 2024 KHITC Notice of Application Availability Public Hearing

On Thursday, Feb. 29 at 2:00 p.m., KHRC will host a public meeting to discuss the Draft 2024 Kansas Housing

Investor Tax Credit (KHITC) Notice of Application Availability.

Virtual Public Hearing

Draft KHITC Notice of Availability

Feb. 29 at 2:00 p.m.

The following resources are available on KHRC’s Moderate Income Housing page under Documents | Forms | Resources:

Written comments regarding the draft 2024 KHITC Notice of Application Availability can be submitted by email to MIH@kshousingcorp.org until March 6, 2024.

Click on a county to view it’s individual Wage-Analysis document.

Housing Calculator Instructions

Click on a county to view it’s individual Wage-Analysis document.

To unlock the developer visit building files, click the link below.

Contact Randy Speaker on updates for this program. Work in progress.

The Housing Assessment Tool (HAT) is a self-assessment guide for communities to gather and analyze data on their housing inventory, partner with relevant stakeholders, and develop priorities for local housing investment. Communities can use this tool to make data-driven decisions in addressing housing investment opportunities.

The recommended timeline for completing the HAT is approximately one to three months but can be dependent on a community’s capacity. Once the HAT is complete, communities have the option to meet with the Housing Interagency Advisory Committee. This is an opportunity for the community to present their housing priorities to discuss state and federal funding opportunities with state representatives.

Step 1: HAT Guide

Download the HAT Guide to review and began recruiting stakeholders to the community’s housing committee to start Part 1. Track answers on a separate document.

Step 2: HAT Form

Download the HAT Guide to review and began recruiting stakeholders to the community’s housing committee to start Part 1. Track answers on a separate document.

The Housing Assessment Tool (HAT) is a self-assessment guide for communities to gather and analyze data on their housing inventory, partner with relevant stakeholders, and develop priorities for local housing investment. Communities can use this tool to make data-driven decisions in addressing housing investment opportunities.

The recommended timeline for completing the HAT is approximately one to three months but can be dependent on a community’s capacity. Once the HAT is complete, communities have the option to meet with the Housing Interagency Advisory Committee. This is an opportunity for the community to present their housing priorities to discuss state and federal funding opportunities with state representatives.

Reinvestment Housing Incentive District (RHID) provide reimbursements to developers in building housing in rural communities by financing housing development infrastructure or renovations of buildings or structures built over 25 years ago for residential use in a central business district. There must be an established RHID defined by an adopted City or County resolution. RHID captures the incremental increase in property taxes created by the development project for up to 25 years. RHID is available for any city with a population under 60,000, counties under 80,000, or the City of Topeka.

RHID captures the incremental increase in real property taxes created by a housing development project for up to 25 years. The incremental increase can be used to pay debt service on bonds issued to fund the project or transferred to the developer as reimbursement for costs incurred.

For a developer to take advantage of the incentive, the property must be within an established RHID. The City or County governing body establishes an RHID and the incentives by:

RHID is authorized for any city in Kansas with a population less than 60,000, counties under 80,000 or the City of Topeka.

The first type of RHID aids cities, counties, and developers in building housing subdivisions within rural communities by assisting in public infrastructure expenses.

The property tax increment can be used to reimburse costs for the following items:

The Moderate Income Housing (MIH) program serves the needs of moderate-income households that typically don’t qualify for federal housing assistance. MIH grants and/or loans are awarded to cities and counties with populations fewer than 60,000 to develop single or multi-family properties for homeownership or rentals. Projects can be for new construction, rehabilitation, or conversion from another use.

The Moderate Income Housing (MIH) program serves the needs of moderate-income households that typically don’t qualify for federal housing assistance. MIH grants and/or loans are awarded to cities and counties with populations fewer than 60,000 to develop single or multifamily properties for homeownership or rentals. Projects can include new construction, rehabilitation, or conversion from another use.

Housing is a statewide silent crisis. But shortages of safe, affordable housing have the greatest impact on our rural communities. In smaller communities across Kansas, a lack of housing creates challenges in attracting and retaining residents. While employment opportunities are plentiful in many communities, housing options are not.

For maximum statewide impact, KHRC limits grants or loans to no more than $650,000 per awardee. Requests for Proposals are released every four months, with applications due three times per year.

Cities and counties with populations fewer than 60,000.

For More Information, Please Email: MIH@kshousingcorp.org

The purpose of the Kansas housing investor tax credit act is to bring housing investment dollars to communities that

lack adequate housing. Development of suitable residential housing will complement economic development of rural

and urban areas that lack adequate housing resources and enable such communities to attract businesses, employees

and new residents.

• $13 million/year in credits

• Set-asides for smaller counties and credit/unit limits

• Counties with a population of 75,000 or less

• Qualified Housing Projects

• Tying this round to Moderate Income Housing (MIH) program

The Low Income Housing Tax Credit encourages investment of private capital in the development of rental housing by providing credits to offset an investor’s federal income tax liability. Financial institutions, such as banks, insurance companies and government-sponsored enterprises, make equity investments in exchange for receiving the tax credits. Equity from the sale of tax credits reduces the amount of debt financing the property owner incurs. This process reduces the property’s monthly debt service, lowers the operating costs, and makes it economically feasible to develop affordable housing.

LIHTC developments provide safe, decent, affordable housing for households at or below 60% of the Area Median Income for at least 30 years.

The 2023 Low Income Housing Tax Credit application process is open.

KHRC evaluates housing tax credit applications based on several characteristics. Priority is given to proposals that:

The Community Development Block Grant (CDBG) program provides funding for projects that help low- to moderate-income neighborhoods thrive. Projects range from sidewalks to community centers, youth job training programs, and much more.

Startup Housing Opportunity Venture Loan – (SHOVL) Pre-Development Loan Program Loan applications open on Thursday April 21, 2022 The goal of SHOVL is to provide funding to developers for expenses incurred prior to the closing of their permanent financing for housing developments in Kansas communities that have experienced housing challenges.